Avivo Teaches Participants How to Budget

One in three Americans prepares a monthly budget and follows it, according to Gallup. People with lower incomes tend to pay a larger percentage of their monthly income toward necessities like housing and utilities.

“Our clients often work on limited incomes,” Nicole says, “So, we’re providing real-life scenarios based on how much ‘money’ each client receives.”

Nicole Mukanda, a manager on Avivo’s housing program for formerly homeless adults, shares they’re giving a creative twist to teaching participants how to budget: a one-day shopping event, using Monopoly money, for program participants.

“Our clients often work on limited incomes,” Nicole says, “So, we’re providing real-life scenarios based on how much ‘money’ each client receives.”

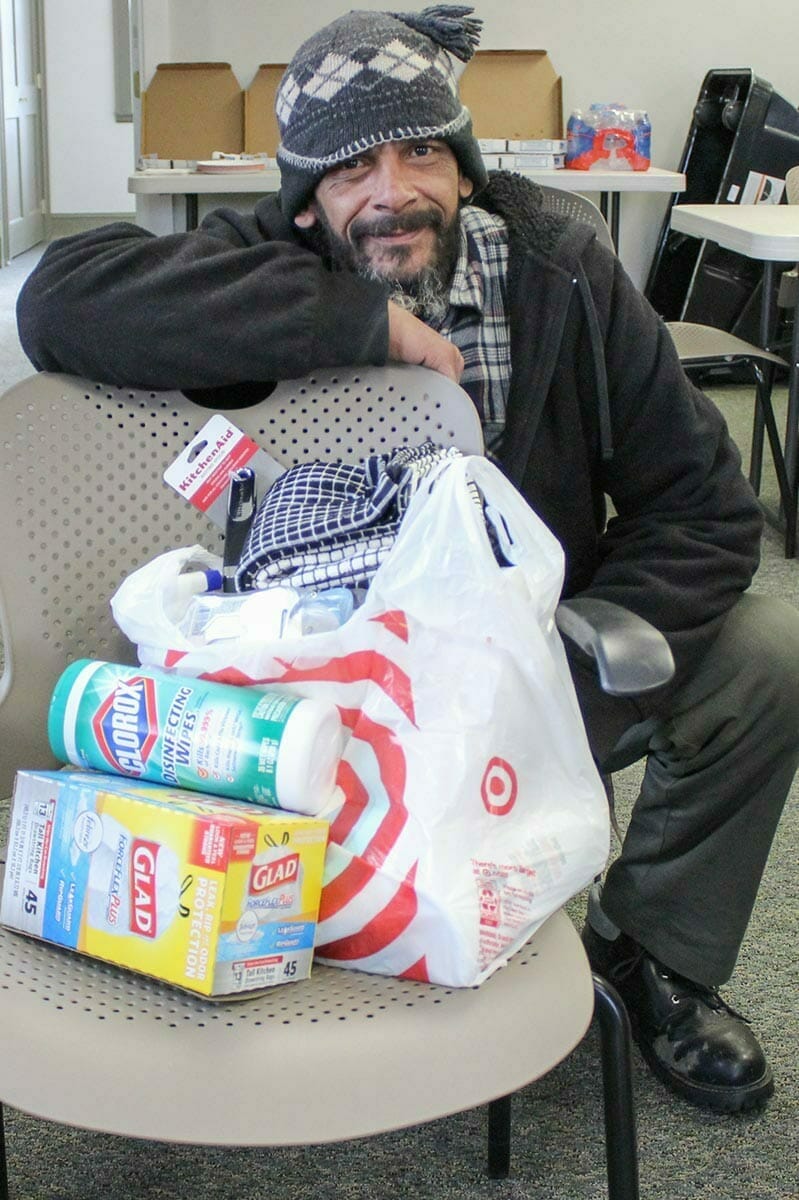

Participants are given Monopoly money to pay rent, pay utilities, and buy items they need or want with a store divided by “wants” and “needs.” Items in the “need” category include hygiene items, cleaning supplies, and socks, while the “want” category consists of games, movies, and kitchen items.

Nicole’s dream is to see this type of event translate into real-life budgeting for their program participants. Staff hope to host similar events for program participants several times per year.